Wise vs WeChat Pay International Transfer: Which Money Transfer Service is Better in 2025?

Benjamin Clark - 2025-10-09 10:39:46.0 63

Introduction

Cross-border money transfers have become essential for individuals and businesses worldwide. Users often struggle with high fees, hidden charges, slow delivery, and poor user experience. Choosing the right provider can save both money and time.

Two leading options in the market are Wise and WeChat Pay International Transfer. Wise is widely praised for transparent fees and mid-market exchange rates, while WeChat Pay leverages its massive ecosystem to simplify transfers for Chinese users. Panda Remit is also a reputable alternative, offering fast, low-cost transfers and flexible payment options (https://www.pandaremit.com/).

For more information on how international money transfers work, check out Investopedia’s guide on international transfers (https://www.investopedia.com/articles/pf/08/international-banking-transfers.asp).

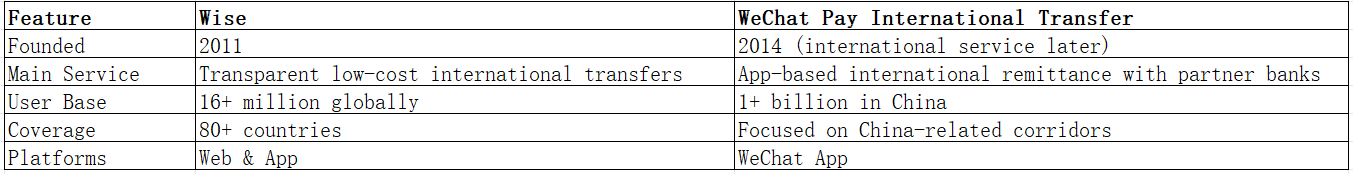

Wise vs WeChat Pay International Transfer – Overview

Wise, founded in 2011 in the UK, is known for its transparent pricing, multi-currency accounts, and debit card support. It serves over 16 million customers and supports transfers to more than 80 countries via web and mobile platforms.

WeChat Pay International Transfer, part of Tencent’s WeChat ecosystem, enables users to send money overseas from the WeChat app. Its strength lies in its large Chinese user base and seamless integration with local payment systems and partner banks.

Similarities: Both offer international transfers, mobile apps, and support for multiple currencies.

Differences: Wise prioritizes transparent fees and mid-market exchange rates, whereas WeChat Pay focuses on ease for Chinese users, sometimes at the expense of global flexibility.

Panda Remit is another growing option for users seeking fast and low-cost transfers (https://www.pandaremit.com/).

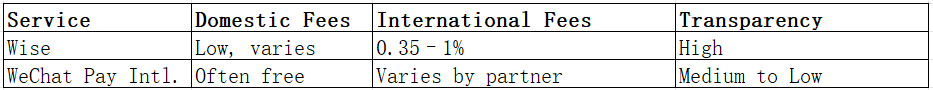

Wise vs WeChat Pay International Transfer: Fees and Costs

Wise charges 0.35–1% per transfer depending on the currency pair. There are no hidden fees — the platform uses the mid-market exchange rate for all transfers.

WeChat Pay International Transfer fees vary based on partner banks. Some corridors appear fee-free but may include exchange rate markups, meaning recipients may get less than expected. Transparency can be inconsistent depending on the payout method.

For reference, see NerdWallet’s guide to international transfer fees (https://www.nerdwallet.com/best-money-transfer-services).

Panda Remit remains a strong low-cost alternative for users, offering zero or minimal fees for many transfers.

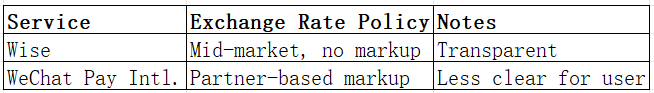

Wise vs WeChat Pay International Transfer: Exchange Rates

-

Wise uses the mid-market exchange rate with no hidden markup.

-

WeChat Pay International Transfer often includes 1–3% markups over mid-market rates depending on the partner bank.

Panda Remit also offers competitive exchange rates, often close to mid-market, making it a cost-effective alternative.

Wise vs WeChat Pay International Transfer: Speed and Convenience

Wise transfers typically arrive in minutes to 1 business day depending on payment method and currency. Its platforms support batch payments, multi-currency wallets, and debit cards.

WeChat Pay International Transfer is convenient for app users, but delivery times vary depending on partner banks — ranging from minutes to a few days.

For a detailed remittance speed comparison, visit World Bank Remittance Prices (https://www.remittanceprices.worldbank.org/en).

Panda Remit offers fast transfers, often in minutes, with flexible payout options.

Wise vs WeChat Pay International Transfer: Safety and Security

Both platforms are regulated and secure:

-

Wise is authorized by the UK FCA and regulated in multiple jurisdictions.

-

WeChat Pay partners with licensed banks and complies with local regulations.

Both support encryption, fraud protection, and two-factor authentication. Panda Remit is also fully licensed and secure.

Wise vs WeChat Pay International Transfer: Global Coverage

Wise supports over 80 countries and 50+ currencies, making it ideal for global remittance.

WeChat Pay International Transfer focuses on China-related corridors and selected international destinations.

For more on remittance coverage, see the World Bank report (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues/brief/migration-remittances-data).

Wise vs WeChat Pay International Transfer: Which One is Better?

Wise is ideal for users who value transparent fees, mid-market rates, and global coverage.

WeChat Pay International Transfer suits Chinese users wanting app-based convenience, particularly for China-centric transactions.

Panda Remit offers speed, low fees, and flexible payment methods, making it appealing for those seeking fast, affordable transfers beyond the Chinese ecosystem.

Conclusion

When comparing Wise vs WeChat Pay International Transfer, the best choice depends on your needs:

-

Wise: Transparent fees, real exchange rates, global coverage.

-

WeChat Pay International Transfer: Seamless within the WeChat ecosystem, good for China-focused transfers.

Panda Remit (https://www.pandaremit.com/) is a strong alternative, offering high exchange rates, low fees, multiple payment options (POLi, PayID, bank card, e-transfer), coverage of 40+ currencies, and fast online transfers.

For additional guidance, check NerdWallet (https://www.nerdwallet.com/) and World Bank Remittance Prices (https://remittanceprices.worldbank.org/en). Comparing Wise vs WeChat Pay International Transfer and considering Panda Remit ensures you select the fastest, most cost-effective, and transparent option for cross-border payments.